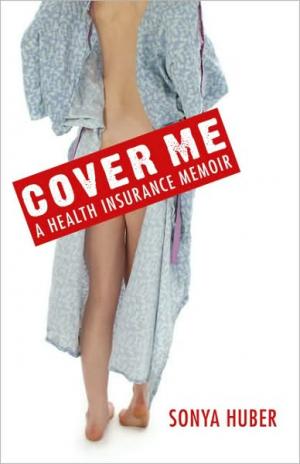

Cover Me: A Health Insurance Memoir

If you suspect that your experiences alone put the hell in healthcare, then Cover Me by Sonya Huber is the memoir for you. By the age of thirty-three, Huber had already endured eleven gaps in healthcare coverage, and had also been sent to collections for medical debt multiple times. She became an expert at scavenging for alternatives and at squeezing every drop of blood from the recalcitrant turnip that is the US healthcare system.

Cover Me is a moving portrait of how access to healthcare determines who is a “have” and who a “have not” and in Huber’s hands, the issues surrounding healthcare reform become clear and relatable. Improbably, given the toll the struggles exact, the author is also very funny, telling her stressful tale with an irrepressible sense of humor.

Huber began her adult employment journey as an idealistic labor activist and became a university professor. At one point, she held down three jobs at once, none of which offered healthcare benefits. The pressure to find affordable healthcare ballooned exponentially as Huber went from single working woman, to wedding a man who was also a healthcare "have not," to becoming a mother.

But even as a single woman, the challenge of good health was daunting. Diagnosed with a disabling panic disorder, Huber was forced to scrounge for low cost medical clinics and sliding scale arrangements, at one point even bartering office cleaning services for therapy. She was often left to rely on two of the universe’s most unstable forces: luck and the kindness of others. At times, sympathetic doctors offered free pharmaceutical samples and dentists forgave their fees. But there were consequences, many of which could be filed under “you get what you pay for,” or more accurately, “you get what you are able to pay for.”

As a wife and mother, Huber’s determination grew even grittier. Schlepping her infant son through the frozen Ohio tundra to register for WIC and Medicaid benefits, and expertly working the phones to correct inevitable and near catastrophic bureaucratic errors, Huber became a master of resourcefulness and tenacity. Even during a rare stretch when Huber had coverage through an HMO, she found it to be Dungeons-and-Dragons-esque, requiring the right "passwords" to gain entry. (The passwords being properly worded referrals and appeals, and an intimate familiarity with the policy’s fine print.) If it’s true that insurance companies spew gobbledygook and denials to weed out folks who lack perseverance, they never counted on someone like Huber.

Huber’s Odyssean journey through the American healthcare system throws the institution's inequities and ironies into stark relief. She describes working for a nonprofit whose mission is to provide low income workers with health insurance; however, in a stunning revelation of either outrageous hypocrisy or business-as-usual in fund-strapped nonprofits, that same organization was unwilling to provide Huber with healthcare coverage. Meanwhile, Huber’s boss, who had stellar insurance through her prominent surgeon husband, could brandish her benefits card and blithely obtain top care. Reading this, you will be tempted to hurl the book against the nearest wall, but you won’t because you’ll be too riveted to let go.

Huber’s story will resonate with anyone who has ever battled a medical bureaucracy. That is, with everybody in America. Her refusal to say “uncle” will inspire, and along the way, readers may even pick up invaluable tips on navigating the labyrinthine depths of both public and private healthcare. There is also a twist at the end that makes university bureaucracy even scarier than its medical counterpart.

One question nagged me throughout Cover Me: where is Huber’s husband? He seemed to hang back and let Huber take the front lines, a story known to too many wives and mothers. But that question aside, and because Huber is such a deliciously skilled writer, Cover Me is the best kind of memoir; it is engaging, enraging, tragic and funny. Fortunately, laughter as medicine is one thing the insurance companies have not yet managed to deny.